What are continuous transaction controls (CTC) for e-invoicing and why are governments turning to them to strengthen their economies? Find out about CTC models being adopted around the world and solutions for keeping up with developments in your markets.

Why governments are choosing continuous transaction controls

Not so long ago, tax authorities began realizing they were losing tax money by using paper invoices as the principal means for recording and reporting business transactions. Since then, governments have started to take action against tax evasion in new ways.

This blog article will define and describe different models and requirements that governments implement to reduce tax evasion. Namely, you’ll discover more about continuous transactions controls, or CTC models.

Go straight to the region you're interested in to read more about their local e-invoice and CTC models or continue reading to learn about the different models.

Table of contents

-

Introduction

-

Overview

-

Regions

-

Conclusion

What are continuous transaction controls (CTC)?

Continuous transaction controls (CTC) enable law enforcement agencies, such as tax administrations, to collect data on business activity in their countries. Unlike traditional invoice reporting, data is obtained directly from business transaction processes or data management systems in real time or near-real time.

CTC addresses the inefficiencies that have always characterized the use of retroactive audits, wherein auditors obtain information on transactions long after their conclusion. In traditional audits, they must also rely on data stored by the very businesses they seek to audit. Continuous transaction controls remove dependency on historical evidence ledgers by making it possible for tax administrations to gather relevant information in the form of a dynamic business transaction ledger.

While some countries do still use post-audit models, most have begun to adopt various CTC models. Although not a rule, geographic location can affect market patterns in CTC models from region to region.

“Service providers can agree amongst themselves which formats to exchange, resulting in open networks with many interoperable formats and service providers.”

Interoperability

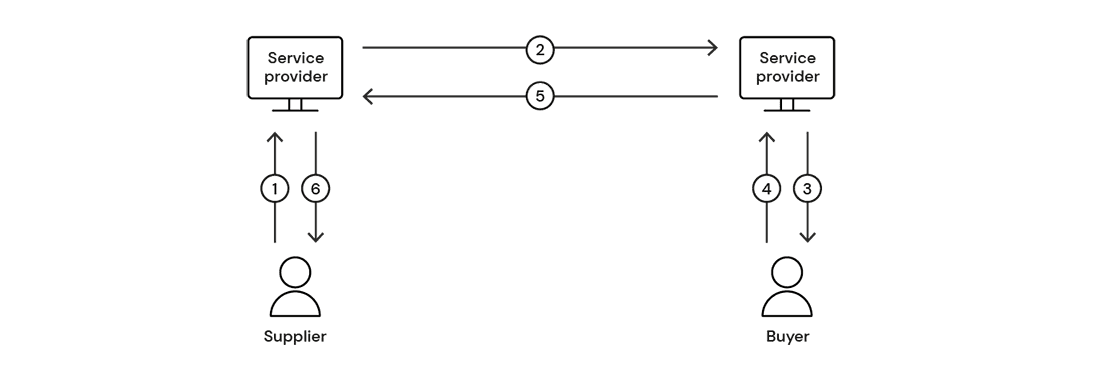

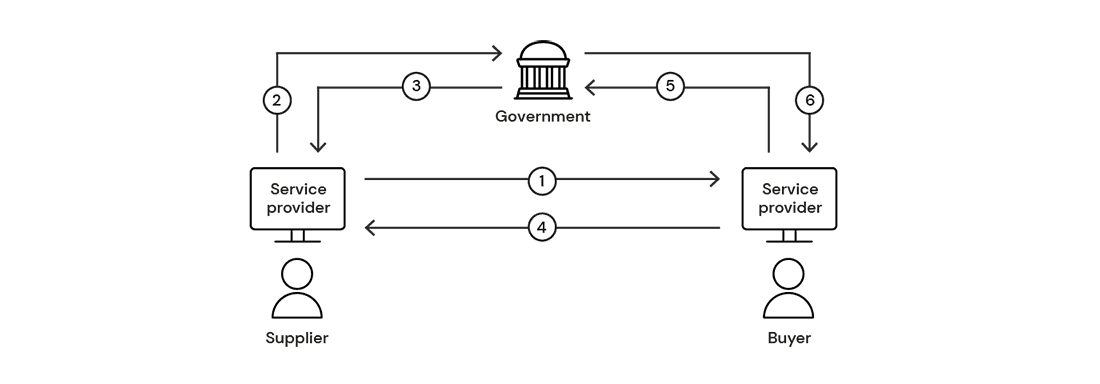

Also called a 4-corner model, the main particularity of interoperability is that taxpayers use a service provider to exchange e-invoices. Moreover, service providers can agree amongst themselves which formats to exchange, resulting in open networks with many interoperable formats and service providers.

Interoperability is not considered a CTC model because the tax invoice audit happens months or even years after transactions occur. The main goal of the interoperability model is to facilitate business automation and digitalization.

Interoperability

Real-time reporting (RTR)

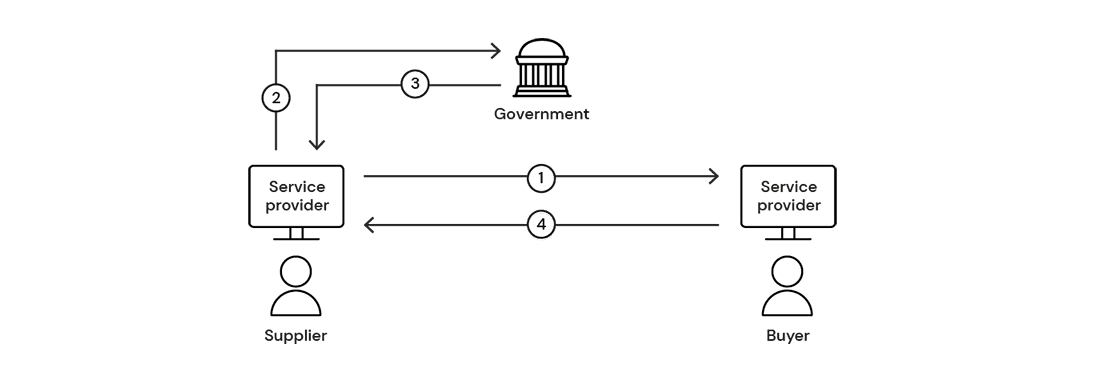

RTIR is a model established in Hungary and South Korea for which there are no regulations regarding invoice exchange. Still, the supplier must report a subset of the invoice to their tax authority in real time after sending it to the buyer. The e-invoice must be in the mandatory format and include specified data such as document type, name and VAT number of trading parties and VAT amounts.

Real-time invoice reporting model (RTIR)

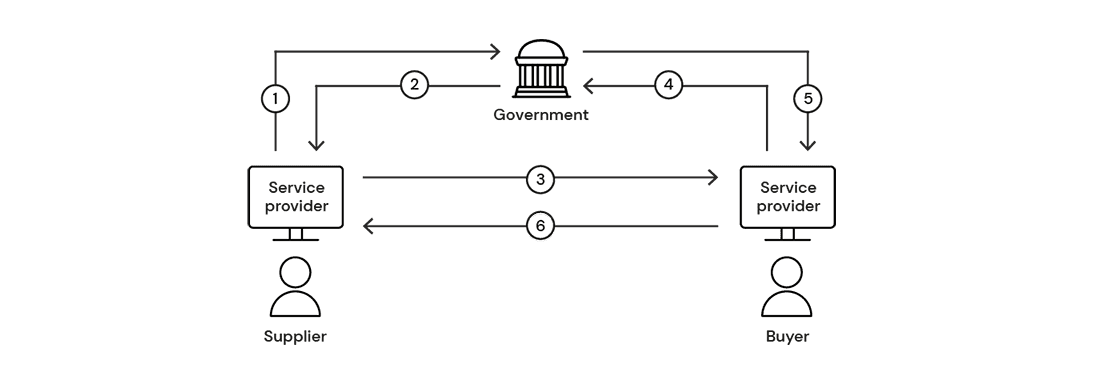

Clearance

Back in 2002, we saw countries like Mexico and Chile start implementing certain requirements for taxpayers. Businesses had to “clear” or “authorize” invoices via tax authority platforms before they could send them to the end recipient (buyer). This CTC model rapidly gained traction, with most Latin American countries deciding to adopt it. However, each country has implemented its own flavour of this CTC model.

Some countries like Mexico, Guatemala and Panama have delegated invoice clearance to Accredited PAC Service Providers (Sp. Proveedor Autorizado de Certificación) instead of local tax authorities.

Pre-clearance or hard clearance models require invoices to be cleared through local government agencies before sending them to the buyer. Other countries such as Chile and Peru have gone with post-clearance or soft clearance models. These allow taxpayers to distribute tax invoices to the buyer before sending them to the tax authority for clearance shortly afterwards.

The clearance model has been expanding to other countries such as India, Saudi Arabia and some countries in southeast Asia.

The Clearance model

Centralized exchange (CE)

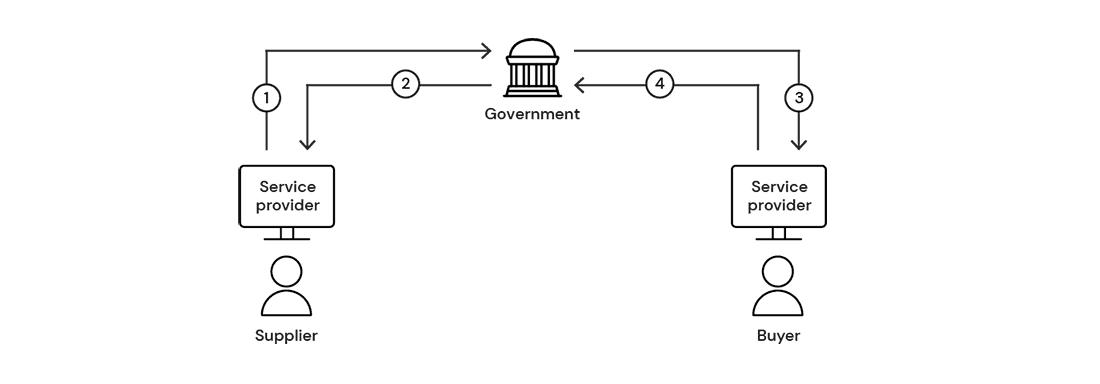

Since the release of the EU Procurement Directive obliging public entities to accept e-invoices, many European countries have implemented new requirements. Mandated e-invoicing from suppliers to government entities (B2G) is becoming common ground across the EU.

Belgium, France, Italy, Portugal, and Spain are just a few markets that have already established infrastructures for receiving invoices on behalf of public buyers. Some countries have selected Peppol as the mandatory exchange mechanism within the centralized model. In these cases, the mandatory platform in the country receives Peppol invoices on behalf of every public entity.

In 2018, Italy went even further and obtained an EU Commission derogation to mandate e-invoicing in the business sector. Every business in Italy is now required to send FatturaPA e-invoices to SDI for the latter to deliver the invoice to the buyer. This led to a successful reduction of tax evasion and more opportunities to strengthen the economy, inspiring other European countries to implement similar models for the same outcome.

Poland is also planning to follow suit and adopt this model on a countrywide level after 2024.

Centralized model

Peppol and Peppol CTC / DCTCE

Peppol is a network that allows the electronic exchange of various documents, including e-invoices. It requires taxpayers to use services of a Peppol Service Provider, or Peppol Access Point, to exchange documents within the Peppol network (a 4-corner model). Access Points are service providers that can generate, send and process the Peppol BIS format, based on UBL 2.1 or CII.

The main difference between Peppol and the interoperability model is that the exchange mechanism is regulated by Peppol, so service providers can only exchange documents in the Peppol BIS format. Even though invoice exchange via Peppol is mandatory in some countries, (e.g., Sweden, Finland, Norway) it is not considered a CTC model because there are no tax authority controls involved.

Peppol CTC is the upgraded version of the current Peppol 4-corner model. In this CTC model, Peppol Access Points report transaction data to tax authorities or via official platforms in real time. This is a great model to allow both automation for businesses and greater control over the economy for tax authorities.

A more generic term applies to this model is DCTCE or Decentralized CTC and Exchange model. The primary difference with Peppol CTC is that the DCTCE doesn’t necessarily build upon Peppol specifications, meaning that other technical standards can be used. Otherwise, currently, these terms can be used interchangeably.

Decentralised CTC & Exchange model

“Hybrid” model (DCTCE + CE)

This model is a mix of the DCTCE and Centralized Exchange models. Currently, this model is present only in France. Spain is looking into potentially similar implementation.

“If you do business in markets that have already adopted continuous transaction controls, it’s important to note that not all CTC compliance solutions are the same.”

CTC and e-invoicing updates

Policy frameworks around electronic invoicing and CTC are being defined all over the world, so now let’s take a closer look at different regions.

Africa

E-invoicing and CTC are still in their very early stages in African nations. Simultaneously, there are no standardized electronic invoicing approaches in Africa's many markets.

The order-to-cash and purchase-to-pay processes in the African region are heavily paper-based. The most common method to exchange invoices between businesses continues to be paper. The extent of utilising electronic means to issue invoices begins and ends with the use of PDF documents. While business automation does not seem to be a priority for many African governments, particular requirements still exist for VAT information transmission to Tax Authorities.

The most popular CTC approach in African jurisdictions seems to be fiscalization. These processes require distinctive hardware devices (Electronic Fiscal devices or EFD) that can report and store VAT data sent to the government. This approach, as well, has been widely adopted with success in several European countries for B2C point-of-sale supplies.

There are still many countries in Africa with no explicit e-invoicing requirements (what would be identified as Post-Audit models), some of which do not allow electronic invoicing at all, equating to the use of paper-based invoicing exclusively. This article presents an overview of select African nations that have implemented e-invoicing and CTC frameworks.

Overview of Africa

As governments are aware of how powerful the tool of e-invoicing is when it comes to combating tax evasion, it is likely that more countries in Africa will adopt e-invoicing in the coming years.

Americas

Latin America

Tax evasion has always been a hot topic in the region. Looking into the requirements, we can see that most of the countries in the region have introduced CTC models, making e-invoicing mandatory for most of the taxpayers. The continuous transaction control approach in those countries has a common denominator, as they follow the Clearance model.

In this model, taxpayers are required to send an invoice (or other transaction documents, such as invoice response, dispatch advise, payment receipt) in a structured format and digitally signed to the tax administration (TA) platform for invoice fiscal validation (clearance). Only e-invoices cleared with the TA obtain the legal validity and can be used between the trading parties.

Furthermore, Clearance model has additional flavours we’re reviewing in greater detail below.

Models of Latin America

North America

Moving to this region, neither Canada nor USA have not implemented a CTC model yet. They have Post-Audit, where tax-relevant documents may be audited by tax authorities months or years after the transactions have occurred. As opposed to Latin America, e-invoicing in these two jurisdictions is driven by businesses that have automation, analytics and cost reduction as their focus areas.

With that said, there is a mainly private driven, countrywide project in the USA to create homogeneous specifications that would allow automation of the Order to Cash (O2C) and Purchase to Pay (P2P) processes called the Digital Business Networks Alliance (DBNA). The DBNA is a collaborative effort aimed at advancing digital innovation and integration within the business sector. It focuses on setting standards, facilitating technology adoption, and sharing best practices to improve global business operations and connectivity.

While we’re not expecting a specific mandate within North America, we foresee an increase in voluntary adoption of DBNA specifications in the US. Companies can still enroll in the pilot, while Pagero can assist with all resources needed for their participation.

Canada is closely monitoring what is being developed in the US, being a member of Peppol at the same time. If Canada were to adopt countrywide e-invoicing or continuous transaction controls, it would rather be following Peppol or BPC standards and specifications, as both frameworks are much more business- and automation-friendly than the models adopted by the Latin American governments.

E-invoicing compliance e-book

Asia-Pacific

Much like in the rest of the world, governments in the APAC region are introducing new legislation related to e-invoicing and financial reporting. Meanwhile, businesses also embrace financial technologies to drive change and create efficiencies. What sets the APAC region apart is the diverse nature of its countries and how local differences influence governmental and business initiatives.

Overview of Asia-Pacific

Europe

Northern Europe and the Baltics

The countries of Northern Europe have long been proponents of digitalization and automatization when it comes to business documents and processes. The widespread adoption of Peppol has laid the foundation for new developments and initiatives.

Overview of Northern Europe

As to the Baltics, Estonia, Latvia and Lithuania are developing and rolling out e-invoicing initiatives within their respective borders.

Overview of the Baltics

Western Europe

Western Europe is a hotbed for some interesting developments on the e-invoicing and CTC front. As with the majority of Europe, most countries are familiar with e-invoices mainly due to public procurement directives. However, in recent years, many Western European countries have begun taking strides towards mandatory e-invoicing in the business sector.

Overview of Western Europe

Central and Eastern Europe

The jurisdictions within Eastern Europe seem to highly favour the centralized model, establishing a mandatory infrastructure for issuing and receiving invoices. A few others are utilizing real-time reporting (RTR) and Peppol. Some also follow the fiscalization approach towards B2C transactions, where special hardware devices must be installed to store and report the data to the government.

Overview of Central and Eastern Europe

Southern Europe

Looking at this region, we can see a great variety of implemented or planned CTC models. Italy and Türkiye have adopted countrywide centralized exchange models, Basque Country in Spain introduced a real-time invoice reporting scheme and Malta with Cyprus are embracing the Peppol approach. Greece, facing an accounting data reporting obligation, plans to implement e-invoicing in the public sector via Peppol.

Overview of Southern Europe

Middle East

In recent years, a lot has happened in terms of digitalization in some of the GCC countries, especially after the introduction of VAT in many parts of the region.

Overview of Middle East

All in all, the Middle East region is in a position to fully embrace the disruptive potentials of digital transformation in the tax controls field. Saudi Arabia is not the first country and won’t be the last to implement continuous transaction controls in the Middle East and North Africa, as other Gulf nations also consider introducing a mandate.

The drive towards CTC obligations & finance automation

As other governments adopt similar strategies to reduce the VAT gap and digitalization of their economies, and as technology advances, the focus isn’t only on compliance. There is a big emphasis on finance automation across order-to-cash (O2C) & purchase-to-pay (P2P) processes.

The European Commission (EC) recently published its VAT in the Digital Age (VIDA) proposal , which will drive even more automation, digitalization and standardization across CTC among the Member States. The European Commission aims to encourage businesses to digitalize their everyday processes.

Once organizations fall under the scope of these mandates, non-compliance is not an option. Governments will impose penalties on those taxpayers that do not meet their obligations. Therefore, organizations have no choice but to find a compliant solution to meet the requirements.

Start as you mean to go on

Typically global, multi-national organizations have tackled these obligations reactively and resolved them country by country by implementing disconnected solutions and processes. Before they know it, organizations have ended up in a spaghetti of software, misaligned data and layered, often overlapping processes.

It hasn’t been until organizations realize the overall cost of sourcing these solutions, managing multiple providers or the IT function gets fed up with building multiple connections that the penny drops, and this becomes a priority at a global level.

Understanding the overall cost of sourcing, implementing and managing multiple compliance service providers across your organization has never been more critical.

With so many existing and upcoming mandates on the horizon, it no longer makes sense to manage these mandates locally or with a reactionary approach. A global strategy is now the only way forward for large multinationals.

This presents an opportunity for businesses to consider the best way for their teams to operate at maximum output with confidence, complying with international CTC e-invoicing obligations in the most efficient way possible so that there are time and resources to leverage strategically across the organization.

This text was originally published April 1, 2022, and last updated on April 30, 2025.

Find out more

Topics:

Related Articles

Have questions?

Get in touch

Interested in getting started or learning more? Leave your contact details here and we will reach out to you!